Many don't realize that our basic utility bills provide the great money saving opportunities for every household!

Especially with today's energy crisis so prevalent throughout many of the states, you've probably heard about – going green.

Guess what, going green really means "using less". Using less energy, means you are spending less money. Inevitably, conservation goes hand in hand with saving money.

We sometimes lose sight of the fact that the water, gas and electricity we use in our homes, always comes back to us in the form of a lovely bill. Use the tips below and you may be surprised to find yourself saving $1000 or more every year.

Electricity:

Electricity:

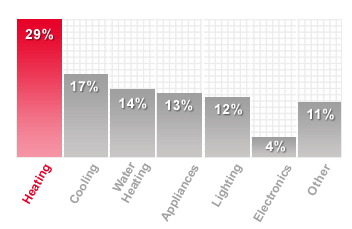

According to energystar.gov, heating consumes 29% and air conditioning consumes 17% of all electricity consumption in the USA. Depending on where you live, air conditioning can account for 60 – 70% of your electric bill during the summer.

Ideally, you want to set up fans to draw in cool air (shady side of house) and circulate into the warmer areas. By installing ceiling fans in the most used rooms, you will feel 3 to 8 degrees cooler. Fans make you feel cooler by evaporating any sweat and by removing the bubble of hot air your body produces around you. Ceiling fans cost as little as $40 to purchase and use 50 – 70 times less energy than a central A/C system. They are also easy to install with few tools required. Make sure your fan is blowing air down during the summer and blowing up in the winter. When the fan is blowing up toward the ceiling it circulates the warm air that collects there toward the floor making your home feel warmer in the winter.

Get in the habit of turning off ALL lights and appliances that are not being used. Be aware that any appliance with a stand-by mode, or transformer before the off switch will still use electricity when turned off. You need to unplug or switch the power supply off in order to prevent electricity leak. You can often tell if an appliance has a transformer before the off switch because it will have a heavy box on the cord. For example laptops have a rectangle box that uses energy all the time to reduce the voltage.

Replace old inefficient appliances with EnergyStar Appliances. Appliances with the ENERGY STAR sticker are required to use 20% less energy than appliances without the sticker. You will save over $100 a year by simply replacing a fridge from the 1980s with an ENERGY STAR fridge.

Consider replacing the following appliances with an ENERGY STAR approved model:

- Natural Gas Furnace, Heat Pump

- Replace Old Thermostats with Programmable Thermostats

- Room and Central A/C System

- Water Heaters: consider a solar water heater or a gas tankless water heater

- Appliances: Refrigerators, Freezers, Clothes Washers, Dryers, Microwave, Range (Oven)

- Lighting: use Compact Flourescent Lights (CFLs)

You'll be surprised at how quickly the energy savings will add up as you consistently take steps to make your home more green.

TURN THE TV OFF!

When everyone is finished watching television, especially before going to sleep, turn it off.

Replace all "non-reading" lights with lower wattage light bulbs or possibly the new "energy plus" bulbs for even more savings over time.

Get in the habit of hanging your clothes to dry, possibly on a clothesline in a bathroom.

Insulate! Insulate! Insulate! Our number one money saving tip! Check the weather stripping around doors and windows. Caulk or foam insulate any place where outside air has a chance to get in. Don't forget to insulate your attic floor with either "roll" or "loose-fill" insulation.

Long Term – Plant tall shrubs and brushes. Not only will this beautify your property, but also shade your home causing less need for the A/C in summer months and help block out harsh winds in colder months.

Water:

Check to make sure none of the faucets & spigots in your household are leaking/dripping. A slow dripping faucet can accumulate over two gallons per hour. When watering the garden, set a schedule and try to water in the early morning hours to help minimize evaporation (between 6am-8am)

Avoid taking baths and reduce time spent in the shower (but who would want to do that?).

Leave the faucet OFF when you are brushing your teeth or shaving. Only turn it on when needed.

If you must wash your car at home, only turn on the hose when you're rinsing.

Gas:

During winter months, light a fire for warmth instead of using the central heating unit. Wood is still cheaper than gas.

Check and make sure the fireplace, chimney, fan, and venting are working properly.

Wear season appropriate clothing around the house. Get used to wearing sweaters and pants during winter months. You'll find that you won't need to turn the heat up as high.

Lower the temperature on your gas water heater. You really don't need water heated up to 180 degrees. Lower it a bit and save.

Turn off the stove and oven a few minutes before the food is done. Residual heat will finish the job perfectly.

Energy Star Savings Finder:

Click the image below to use a fun graphical tool to educate yourself and your family in ways you can save all over your house:

Wireless Phone Bill & Internet:

Wireless Phone Bill & Internet:

A significant monthly bill for most families is the wireless phone plan especially if it includes an internet data plan. Most cell phone plans come with a default feature that you may not use. For example many family plans from Verizon Wireless include unlimited text messages, but if you are not sending a lot of text messages, you will save by downgrading to 500 prepaid text messages a month. If you don't use a lot of talk time, consider a prepaid cell phone like Net10.com. You will only pay 0.10 per minute and 0.05 per text. Prepaid cell phones as a means of reducing expenses are becoming much more popular due to the ongoing economic recession.

The basic strategy with your cell phone bill and internet bill is to audit your bill and see where you can save and also compare your provider with others and switch if you'll save money. Check out our post:

"How I Save $75.77 Every Month on My Verizon Bill"

If you're already paying for the internet, consider an internet phone like Skype. For $2.99 a month you get unlimited minutes to call any cell phone or land line in the US. You can also buy your own virtual phone number from Skype so others can make calls direct to your PC whenever it is on and connected to the internet. Currently we use Skype for a business phone solution and it has reduced the amount of cell minutes we use.

The degree of accuracy you put towards this task is up to you as always, but at some point you will need to list out all your monthly expenses. To put your mind at ease, you don't need to spend hours upon hours calculating averages and compiling data for the past decade. You simply need to list out each and every expense you pay per month.

Here are some of the most common monthly expenditures for households:

- Electricity

- Mortgage

- Car Payment

- Vehicle Expenses (oil changes/tires/wipers and unless your car is new, repairs)

- Food

- Clothing

- Auto & Home Insurance Premiums

- Health & Life Insurance Premiums

- Phone Bill

- Gasoline

- School (books,tuition,transportation,etc)

- SPORTS (baseball leagues,soccer, football, Scouting, dance lessons, karate, etc)

- Dining Out

- Pets

- Heating Bill

- Pets (food, shots, Vet checkups, litter)

- Water

- Internet (ISP)

- Home Cable TV

- Entertainment

- Medical (vitamins, medicines: Rx & OTC, checkups, procedures)

- Church (tithing & donations)

- Donations to Charities

- Miscellaneous

If you have the most current statements handy, then by all means use the exact amounts, however try not to let this exercise consume more than an hour of your time. This is not meant to depress you, or criticize your spending habits. It is merely a list to help provide you with a "bird's eye view" of how and where you spend your money.

To come up with extra money, or to generate a substantial increase in your monthly savings, you MUST first find out where you are spending the money you earn.

Now that you're saving on your bills, start saving the savings in an online savings account, CD account, or money market account.